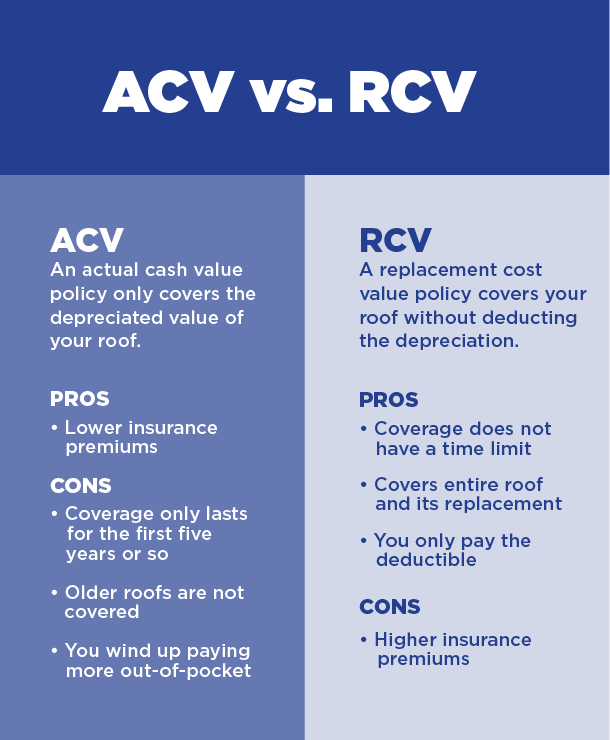

When a storm hits, you want your roof damage to be covered by your home insurance. What you don’t want is an unpleasant surprise that the policy you have doesn’t have you covered. But that is often exactly what happens to people who have actual cash value ACV policies instead of replacement cost value RCV policies.

ACV and RCV are roofing policies found in your homeowners insurance. It’s critical to know the difference between these two policies if you’ve encountered any kind of damage to your roof. You want to have an RCV policy and not an ACV policy. If you have a big roof and not a lot of money in the bank when a storm hits and you have an ACV policy, you’re going to be in trouble.

What is an ACV policy?

This type of policy exists to give homeowners a cheaper insurance option—but it is cheaper because it only covers your roof for the first five years or so. The discount you get with an ACV policy is not worth it in the long run. Why? If you have an old roof and you are expecting insurance to cover the full cost and replace the roof after storm damage, this policy will not cover it.

Homeowners are often surprised when they find out they have this type of insurance coverage. The consequence is paying thousands of dollars out of pocket for a new roof. If the bill is too large, homeowners often can’t afford to fix the roof and they live with damage or try to patch it and deal with ongoing wear-and-tear issues.

Insurance agents don’t explain this policy well, resulting in customers who don’t know what kind of insurance they are signing up for.

Don’t go for the lower insurance premium with an ACV basis. If a storm comes, you don’t want a big roofing bill. Storms are becoming more frequent in Iowa, so it is a good idea to review your policy today. With an ACV policy, you may think you have insurance, but you really don’t.

What is an RCV policy?

This type of policy covers your whole roof and its replacement—you only have to pay your deductible. Most deductibles are around $2,000 to $3,000. If you own a home, you will want to make sure this is the type of policy you have.

Every insurance company is different in how they operate, so be sure to read the fine print. For example, some policies are RCV, but then switch back to ACV at a certain point, based on the age of your roof. If this is the type of policy you have, we advise you to save your receipts and invoices. That way, when you get switched in 10 years, for example, you won’t have to pay out of pocket to replace the item. If you don’t have proof of your roof’s age, then you may not get your new roof covered. It is important to show insurance adjusters proof.

Can I switch to an RCV policy?

You can’t switch your policy from an ACV to an RCV after a storm event. You can only do it before. So take the time now to check your policy and have it updated.

If I have storm damage, what actions should I take now with my insurance company?

The first step is to file a claim. People are often afraid to file claims because they don’t want their insurance premiums to go up, but it is actually against federal law for an insurance company to raise your rates simply because you filed a homeowners claim.

It may seem like that is the case because sometimes rates do go up around the time you file a claim, but it is because the entire region was hit by a devastating storm. Insurance must pay for the billions of dollars of damage somehow, so they raise their rates on everyone in that region.

To file a claim and get on a schedule:

- Call your insurance company using their 1-800 number or, if they have an app, download it and film your damage. Don’t contact your insurance agent. Agents can sometimes slow down the process, saying you should get an estimate from a roofing company before filing a claim, but your agent doesn’t have anything to do with the claims process. It’s in their best interest if your claim goes away. The more claims they have out there, the more detrimental it is for their agency. Once you file your claim, the insurance company will assign you an adjuster and they will look at your roof. They will sit in their truck and do an exact estimate. They will then print out everything that’s wrong with your roof and cut you a check all in that one visit. You never end up talking to the agent in that scenario.

- Call a trusted roofing company that knows a lot about insurance claims. Show your insurance estimate to the knowledgeable and trusted roofer. It’s in your best interest to have the roofing company review your claim because they can speak that language and know if you’re getting a good or bad deal from your insurance.

- Sign up with the roofing company and get on their schedule.

Should I have my insurance claim supplemented?

There are great insurance adjusters out there, but they are working for the insurance company. As much as they are trying to help you during a storm, a lot of times you will get low-balled and they won’t pay the total amount they are supposed to pay.

Sometimes this can be an honest mistake by adjusters (e.g., they get the square footage wrong or the amount of layers on the roof), but these honest mistakes can dramatically affect the amount of money you get paid. Other times, the adjusters are trying to save the insurance company money.

Supplements are basically someone going through what insurance says they are willing to pay and saying, “Hey, you forgot about this. You forgot about that. Can you please include these items that you forgot about?” It is an attempt to make the insurance estimate more accurate.

You should always have someone knowledgeable and that you trust look over your insurance claim. If you find a roofer you trust, work with them as long as you know they are knowledgeable on insurance claims and have your best interest at heart.

Our team is an advocate for our customers and we have successfully supplemented insurance companies to the tune of an extra $5,000 or $6,000 on a regular basis. In some cases, we’ve gotten insurance companies to pay an additional $180,000 on top of what they initially attempted to pay.

Carrie’s Story

Carrie received wind and hail damage to her roof. After we inspected it, we used ITEL and sent in a sample product so we could get a report on when it was manufactured to see if there was a suitable product to do a patch. There wasn’t a suitable match. So once we got the report back, we passed it on to her insurance. Her insurance was going to pay her $8,000 for the repairs, but instead, with our help, they ended up paying her $42,000 to replace the whole roof.

One Church’s Story

When the church experienced storm damage, insurance said they were going to pay $26,000. Hopkins advocated on their behalf and got the estimate up to $166,000. Then Hopkins supplemented the estimate with all the things that were missing. In the end, the insurance company paid a total of $209,000.

Find a Trusted Advocate

Hopkins Roofing has your best interests at heart and is here to help. For assistance navigating the insurance process, call us today!